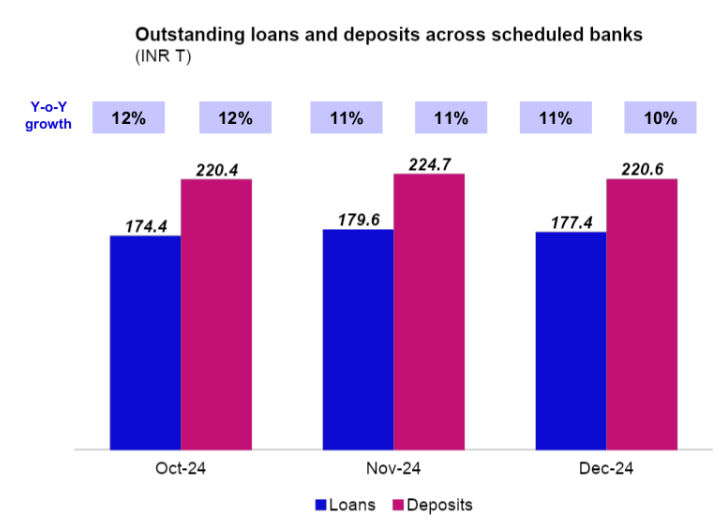

The BFSI sector recorded steady credit growth with an increase in overall outstanding loans by approximately 11 per cent on a year-on-year basis in December 2024 which is same as the year-on-year credit growth depicted in November of 2024. Deposit growth stands at 10 per cent year-on-year, and a dip of 1 per cent from the previous month.

The outstanding loans across scheduled banks witnessed a dip of 1 per cent month-on-month and a 10 per cent year-on-year increase, totalling Rs 177.4 trillion in December 2024. This compares with Rs 179.6 trillion in November, Rs 174.4 trillion in October, and Rs 172.9 trillion in September.

The Reserve Bank of India’s financial stability report underscored the notable credit expansion across both public and private sector banks.

Outstanding loans in scheduled banks were growing at a higher pace than deposits, currently showed stagnation. Deposits across scheduled banks recorded approximately 10 per cent year-on-year growth in December. However, on a month-on-month basis, deposits decreased to Rs 220.6 trillion in December from Rs 224.7 trillion in November, compared to Rs 220.4 trillion in October.

In the past two years, aggregate deposit growth saw moderation, especially during 2021-22. However, a report by the State Bank of India highlighted that between FY14 and FY23, banking credit surged from Rs 60 trillion to Rs 138 trillion, a 2.3 times increase, while deposits rose 2.4 times from Rs 77 trillion to Rs 187 trillion.

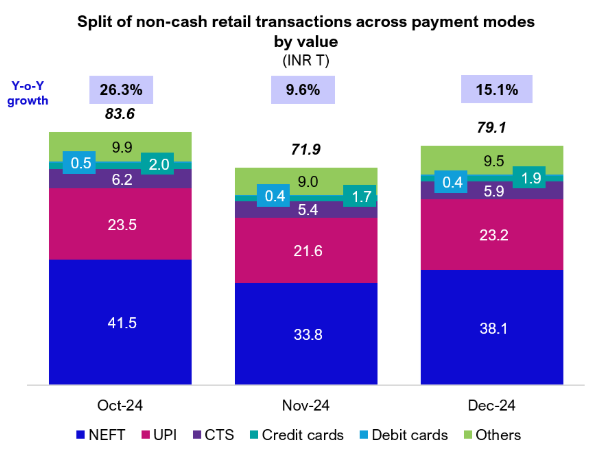

Growth in non-cash retail transactions

The 1Lattice data indicated a 15.1 per cent year-on-year increase in December 2024 for non-cash retail transactions. In December, it reached Rs 79.1 trillion, and in November, this was Rs 71.9 trillion.

The National Electronic Funds Transfer (NEFT) mode dominated non-cash transactions, accounting for 48.1 per cent, followed by Unified Payments Interface (UPI) at 29.3 per cent.

NEFT recorded Rs 38.1 trillion worth of transactions, followed by UPI with Rs 23.2 trillion transactions, Cheque Truncation System (CTS) with Rs 5.9 trillion worth of transactions and credit and debit cards with Rs 1 and Rs 0.4 trillion respectively in December 2024, the data added.

Leave a Reply