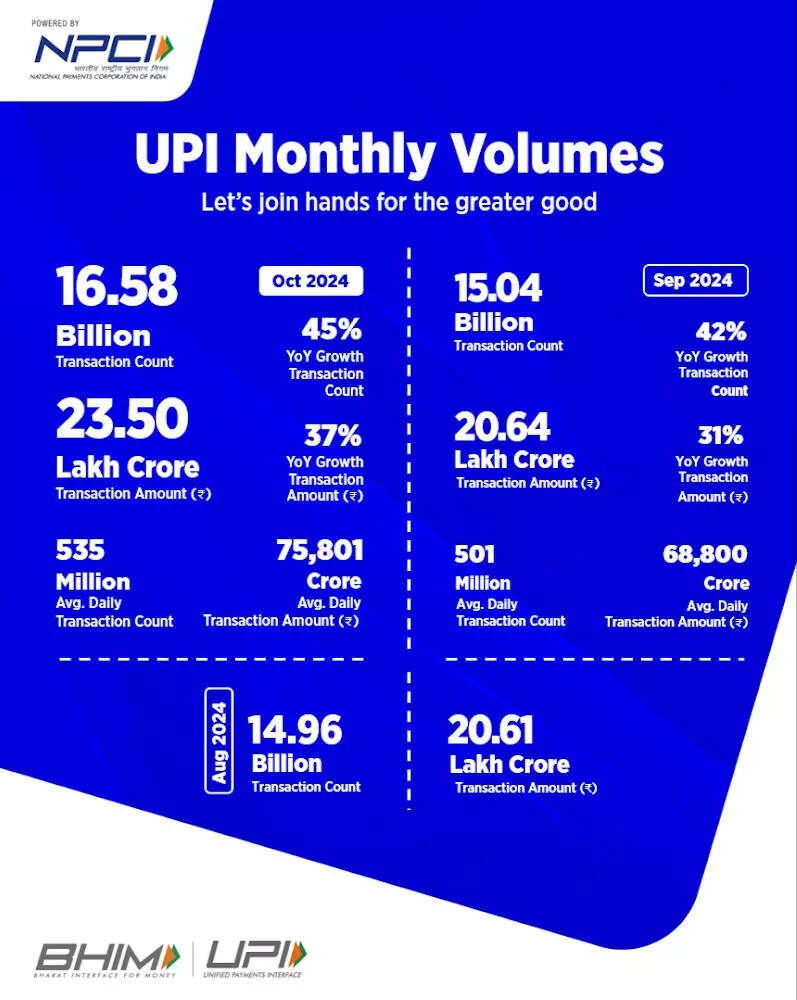

Unified Payment Interface (UPI) transactions experienced an increase in volume month-on-month, reaching an all-time high of 16.58 billion in the month of September, 2024, crossing the 16 billion transactions mark, up from 15.04 billion in September, revealed latest data by National Payments Corporation of India (NPCI).

In terms of value, the month of September recorded Rs 23.50 trillion worth of transactions, a significant month-on-month uptick compared to that of September, recording Rs 20.64 trillion worth of transactions in September.

This growth indicates a continued adoption of digital payments in India, with UPI remaining the leading platform. The increase in volume and marginal uptick in value, suggests that users are making more frequent transactions with lower average values.

In FY24, UPI transactions crossed 100 billion and closed at 131 billion worth a whopping Rs 199.89 trillion. In FY23, the UPI platform processed a total of 83.76 billion transactions aggregating Rs 139 trillion, compared with 45.97 billion transactions worth Rs 84 trillion in FY22.

UPI transactions are expected to breach 100 crore transactions per day by FY27, UPI is set to dominate the retail digital payments landscape, accounting for 90 per cent of total transaction volumes over the next five years, a recent report by PWC India highlighted.

Year-on-Year Growth

Compared to October 2023, UPI transactions saw significant year-on-year growth of 45 per cent in volume and 37 per cent in value, the NPCI data further revealed.

This substantial increase highlights the rapid expansion of digital payments in India, driven by government initiatives, increasing smartphone penetration, and growing consumer comfort with online transactions.

The sustained growth of UPI transactions underscores its position as a preferred payment method for Indians.

Other Digital Payment Channels

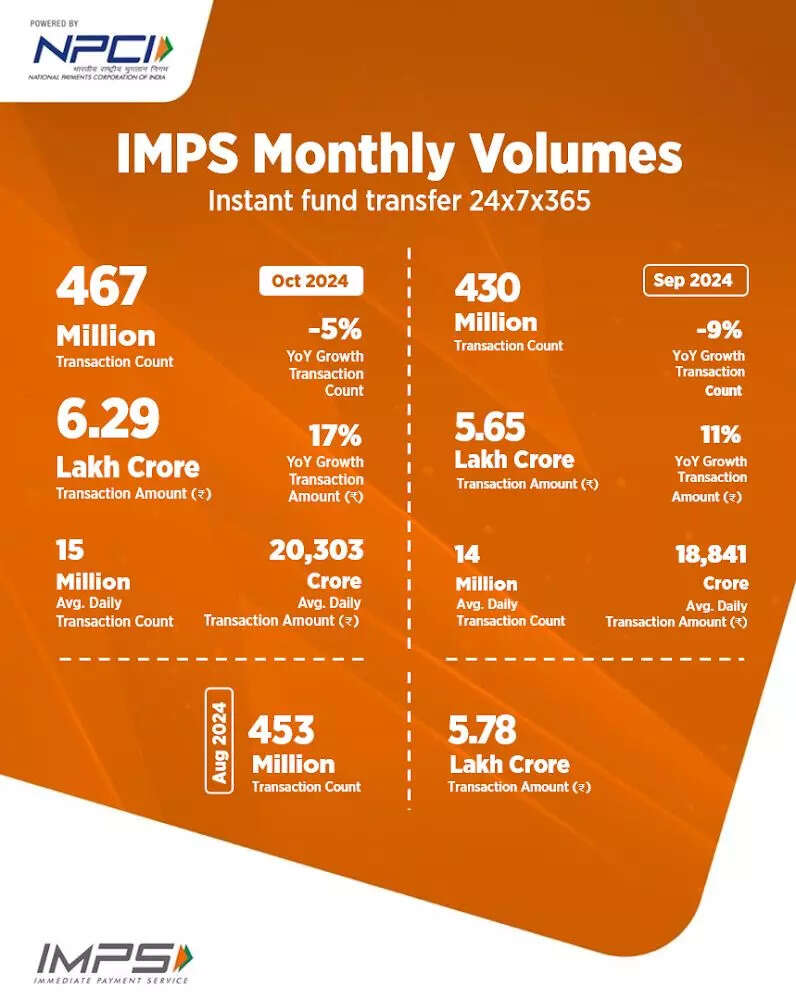

IMPS transactions surge: While Immediate Payment Service (IMPS) transactions decreased by 5 per cent yoy in volume to 467 million in October, it displayed a significant month on month increase, up from 430 million in September 2024.

In terms of value, IMPS transactions witnessed a significant increase in October recording Rs 6.29 trillion worth transactions, compared to Rs 5.65 trillion in September. The numbers recorded a yoy growth of 17 per cent in October, up from 11 per cent in September this year.

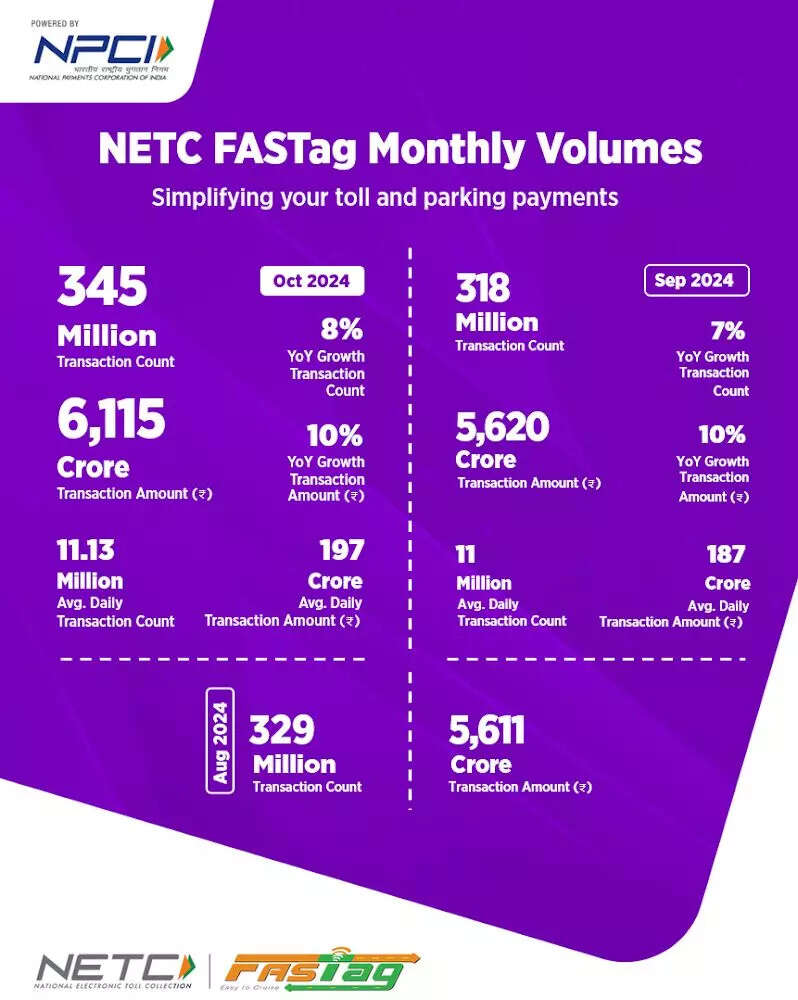

FASTag transactions rise: FASTag transactions increased by 8 per cent yoy, also recording a significant month on month increase to 345 Mn in volume from 318 million transactions in September.

In terms of value, FASTag transactions rose significantly to Rs 61.15 billion in October, compared to Rs 56.2 billion in September. Year-on-year, FASTag transactions saw a 8 per cent rise in volume and 10 per cent rise in value compared to October 2023.

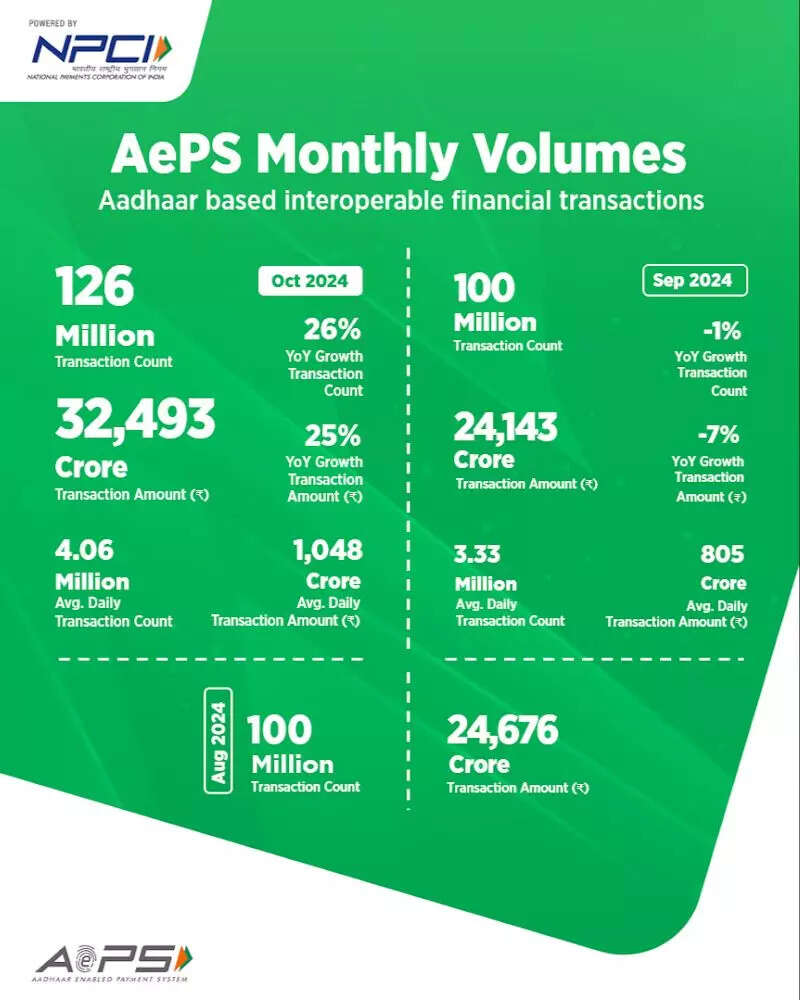

AePS Transactions also increase: Aadhaar Enabled Payment System (AePS) transactions witnessed a whopping 26 per cent yoy increase.The transactions volume increased to 126 Mn in October from 100 Mn in September.

In terms of value, AePS transactions increased 25 per cent yoy and witnessed a significant increase on a monthly basis, recording Rs 324.9 billion in October, compared to Rs 241.4 billion in September.

Leave a Reply