FinTech Non-Banking Financial Companies (NBFCs) have significantly outpaced banks and traditional NBFCs in transaction volume. However, their contribution to the overall sanction value remains modest, stated a report by FinTech Association of Consumer Empowerment.

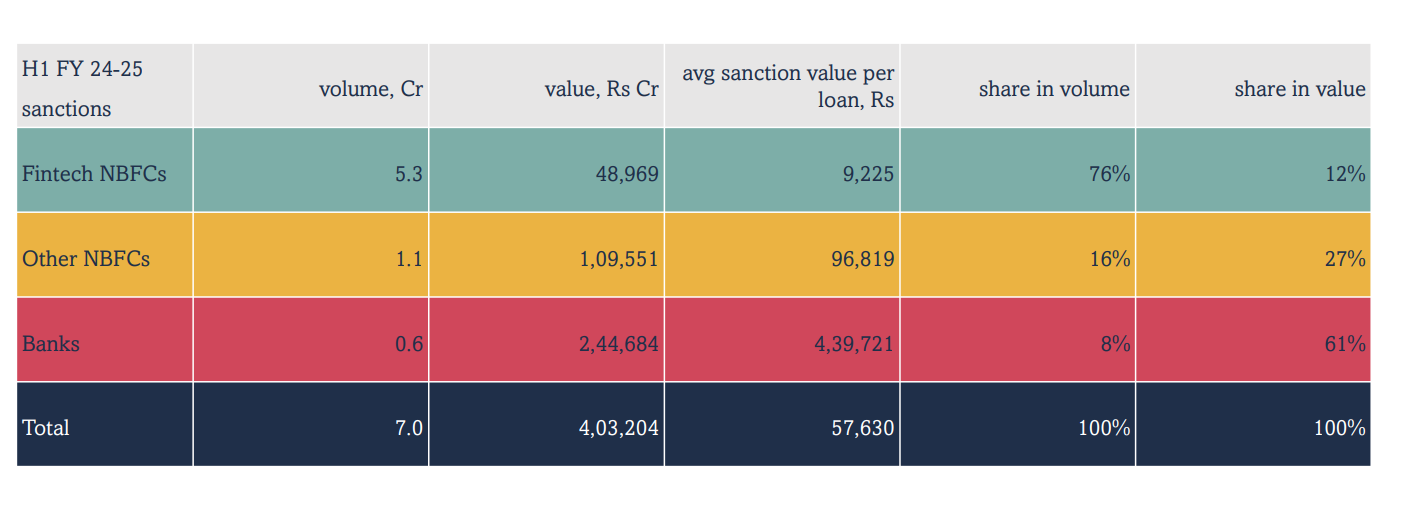

Personal loan sanctions in H1 FY25 reached 7 crore in volume, amounting to Rs 4 lakh crore in value. Of this, FinTech NBFCs accounted for 5.3 crore loans worth Rs 48,969 crore, which is 76 per cent of the total volume but only 12 per cent of the total value. The transaction volume of FinTech NBFCs has increased significantly, from 4 per cent in FY19 to 12 per cent in H1 FY25. Their transaction value share also rose from 29 per cent in FY19 to 76 per cent in H1 FY25.

Banks, on the other hand, have seen a steady decline in their share of personal loan sanction volume, dropping from 44 per cent in FY19 to 8 per cent in H1 FY25. During this period, banks sanctioned 0.6 crore loans, accounting for Rs 2,44,684 crore, which represents 61 per cent of the total transaction value. The average sanction value for banks stood at Rs 4,39,721.

Traditional NBFCs contributed to 1.1 crore personal loan transactions, valuing Rs 1,09,551 Crore, with an average transaction size of Rs 96,819.

The FACE report highlighted that while the growth in sanction value was flat in H1 FY25, sanction volumes increased by 14 per cent compared to H2 FY24.

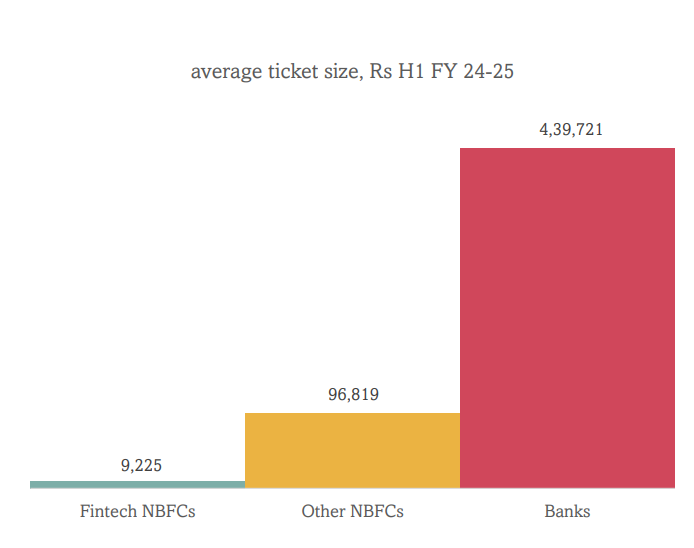

Variation in ticket sizes for FinTech NBFCs

The average sanction value by FinTech NBFCs in H1 FY25 was Rs 9,225. FinTech NBFCs, which leverage innovative financial technology to extend credit, saw 41 per cent of their ticket sizes falling below Rs 25,000. Loans between Rs 25,000 and Rs 50,000 accounted for 16 per cent, while 13 per cent of sanctions were for amounts between Rs 1 lakh and Rs 2 lakh. Tickets between Rs 2 lakh and Rs 5 lakh contributed 15 per cent, while only 2 per cent exceeded Rs 5 lakh.

For traditional NBFCs, 29 per cent of tickets were valued above Rs 5 lakh. By contrast, 69 per cent of loans sanctioned by banks had ticket sizes exceeding Rs 5 lakh, with only 0.3 per cent falling below Rs 25,000.

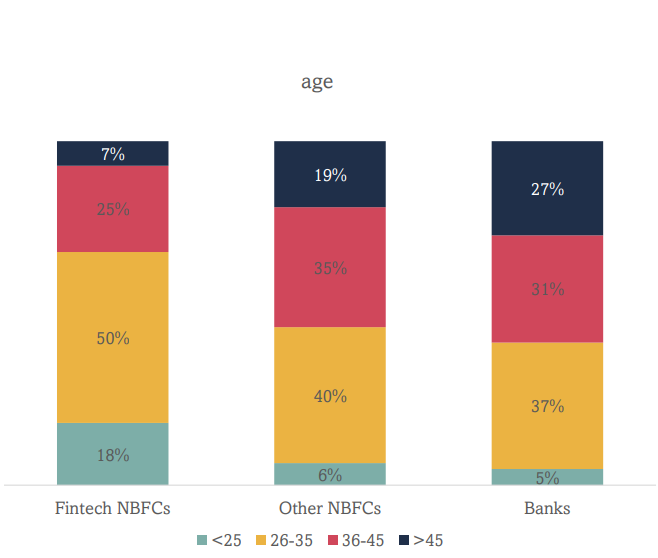

Age

FinTech NBFC borrowers are predominantly younger, with over two-thirds aged below 35 years. Half of their borrowers fall within the 26-35 age bracket, while only 7 per cent are older than 45 years. In comparison, banks have a larger share of older borrowers, with 27 per cent aged above 45 years.

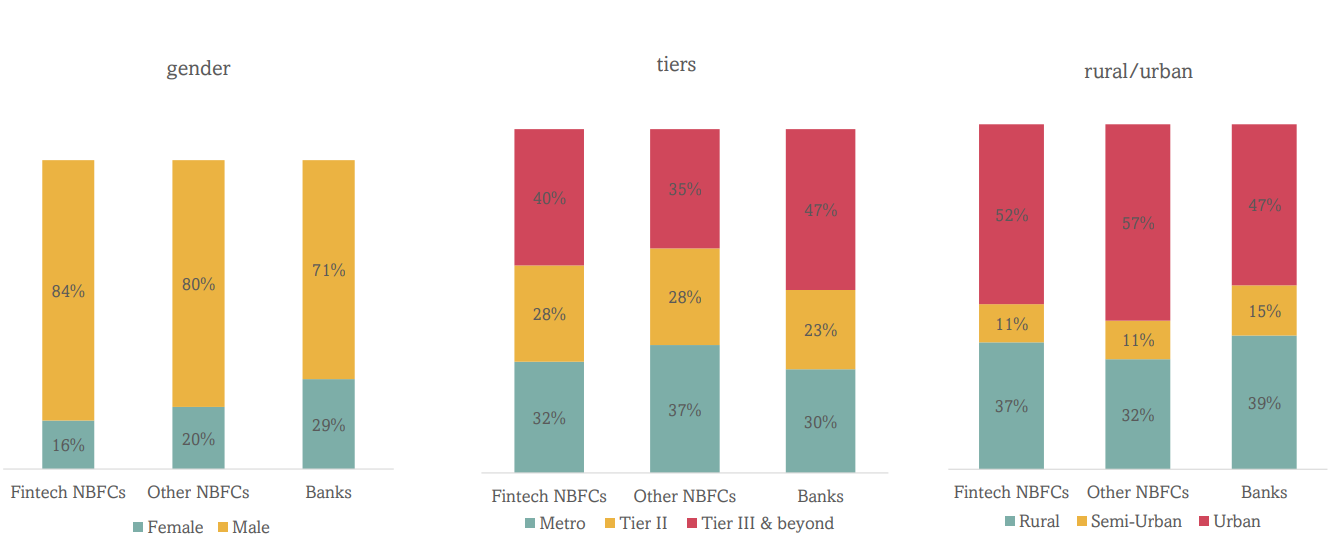

Gender and Regions

Female borrowers constituted 16 per cent of FinTech NBFC customers, compared to 29 per cent for banks. Interestingly, women borrowed higher ticket sizes on average, at Rs 10,717, compared to Rs 8,994 for men.

Borrowers from metro cities formed 32 per cent of FinTech NBFC customers, while 30 per cent of metro dwellers opted for banks. FinTech NBFCs attracted 37 per cent of their borrowers from rural areas, slightly less than banks, which accounted for 39 per cent.

State-wise insights

Maharashtra, which accounted for 20 per cent of sanction value in FY19, saw its share decline to 13 per cent in H1 FY25. Delhi recorded the highest average ticket size in H1 FY25, at Rs 13,346, followed by Gujarat, Karnataka, and Maharashtra.

Leave a Reply