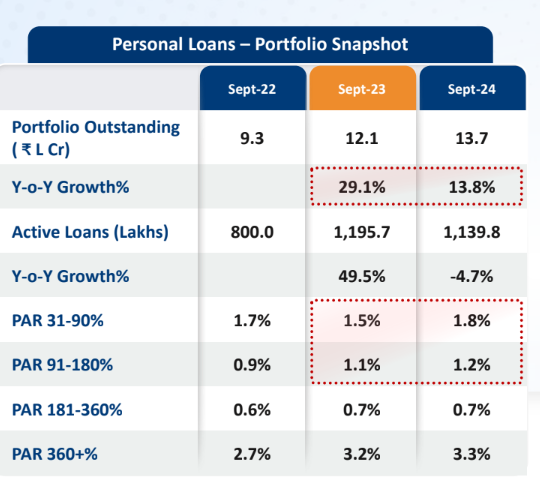

India’s lending market experienced a slowdown, with Year-on-Year (YoY) growth in personal loans declining to 13.8 per cent in September 2024 from 29.1 per cent in September 2023, according to a report by credit bureau CRIF.

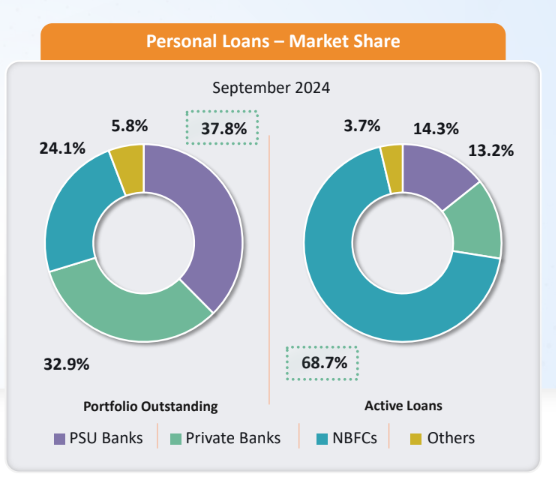

Market Share Distribution

Public sector banks held the largest share of the portfolio outstanding as of September 2024, accounting for 37.8 per cent, followed by private banks with 32.9 per cent and non-banking financial companies (NBFCs) with 24.1 per cent. However, in terms of the number of active loans, NBFCs dominated the market with a significant 68.7 per cent share, while public sector lenders contributed 14.3 per cent and private banks 13.2 per cent.

Loan Origination Trends

The origination value of personal loans saw a year-on-year decline of 5.5 per cent, coming down to Rs 4,03,204 crores in the first half of FY25 from Rs 4,26,727 crores in the same period of the previous fiscal. Despite this, origination volume increased by 3.4 per cent, rising from 668.9 lakh loans to 691.5 lakh loans.

The majority of personal loan originations came from NBFCs, which accounted for 90.7 per cent of the total volume, while private banks and public sector banks held market shares of 4.8 per cent and 2.8 per cent, respectively.

Risk and Portfolio Quality

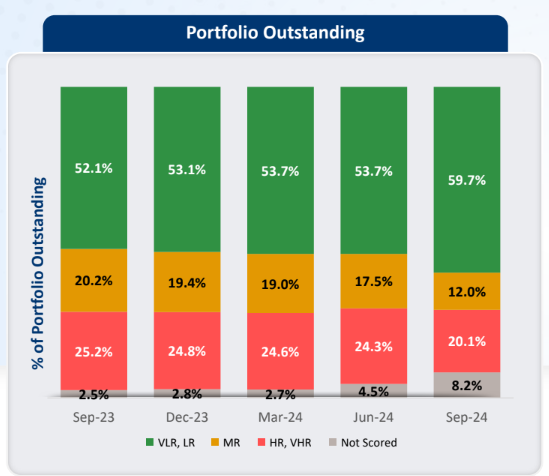

The outstanding loan portfolio in the first half of FY25 saw a decline in high-risk segments, indicating a shift towards lower-risk lending. The share of very high-risk and high-risk portfolios fell from 25.2 per cent in the first half of FY24 to 20.1 per cent in the corresponding period of FY25. Medium-risk portfolios also saw a drop, coming down from 20.2 percent to 12 percent. At the same time, very low-risk portfolios increased to 59.7 per cent in the first half of FY25 from 52.1 per cent in the same period last year.

A similar trend was observed in active loans, where high-risk loans declined from 39.9 per cent in the first half of FY24 to 37.8 per cent in FY25. Medium-risk loans also saw a decrease, dropping from 17.8 per cent to 11.9 percent.

Lending activity across geographies

Lending activity continues to shift towards smaller towns and cities beyond the top 100 urban centers. These regions accounted for 38.7 per cent of the total origination value in the first half of FY25, compared to 39.9 per cent in the same period last year. The share of top 9-50 cities stood at 17.6 per cent, while the top 8 cities contributed 33.4 per cent. In terms of origination volume, smaller towns and cities held a 42 per cent share, while the top 8 cities accounted for 26.9 per cent.

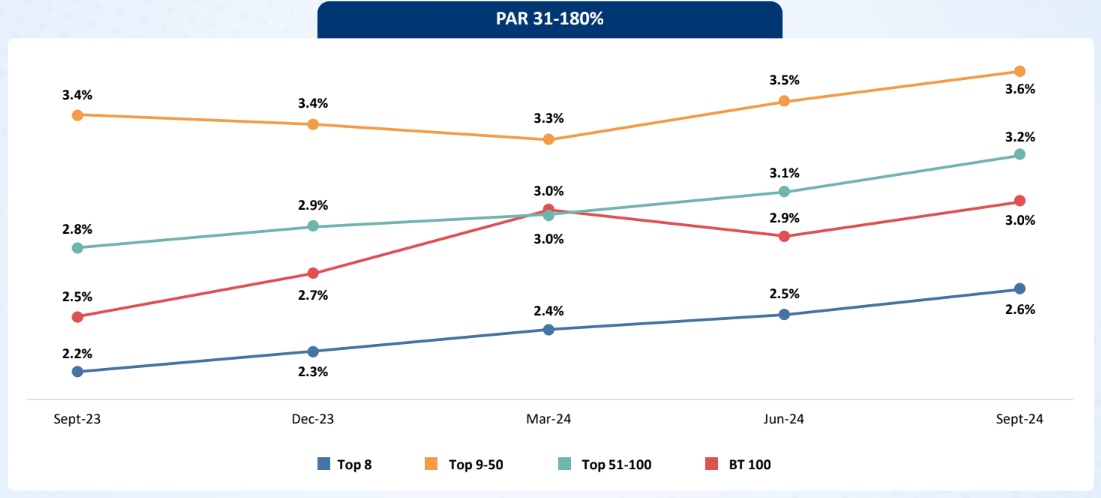

Across all geographies, loan delinquencies have increased compared to the first half of FY24. In the top 8 cities, delinquencies rose from 2.2 per cent to 2.6 percent. In smaller towns and cities, the proportion of overdue loans increased from 2.5 per cent to 3 per cent, while in mid-sized urban centers ranked 51-100, the figure rose from 2.8 per cent to 3.2 per cent. The top 9-50 cities saw delinquencies rise from 3.4 per cent to 3.6 per cent.

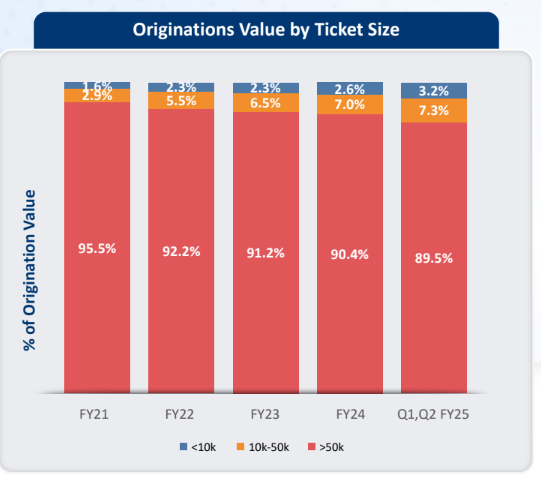

Ticket Size Distribution

The majority of personal loan originations in terms of value came from loans under Rs 50,000, which accounted for 89.5 per cent of the total. Loans in the Rs 10,000 to Rs 50,000 range made up 7.3 per cent, while loans under Rs 10,000 contributed 3.2 per cent. However, when measured by volume, smaller-ticket loans dominated, with 66.9 percent of disbursements coming from loans below Rs 10,000. Loans in the Rs 10,000 to Rs 50,000 range accounted for 17.3 per cent, while those under Rs 50,000 made up 15.8 per cent.

Leave a Reply