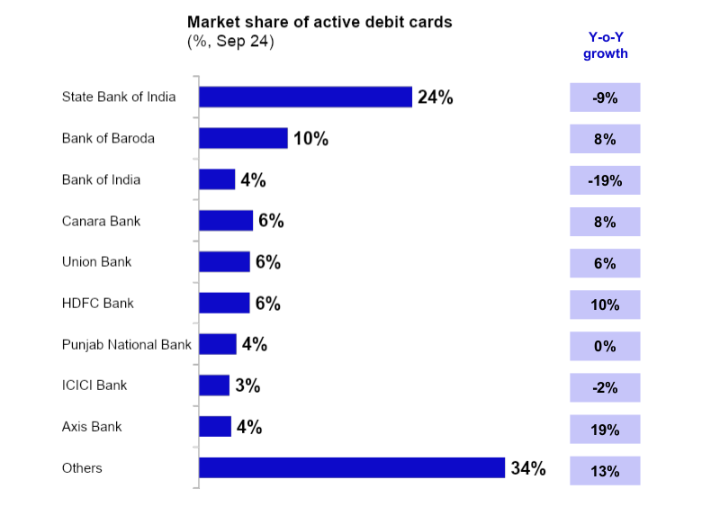

India’s largest public sector bank, State Bank of India, maintained its leadership in the debit card market, holding an impressive 24% market share in September 2024, while HDFC Bank remained the top player in credit cards with a 21% share, according to recent data from 1Lattice.

Other top banks in debit cards included Bank of Baroda with a 10% market share, followed by Canara Bank, Union Bank, and HDFC Bank, each with about 6%, and Bank of India at 4%.

In the debit card segment, HDFC Bank and Axis Bank experienced the strongest year-on-year growth, registering approximately 19% and 10% respectively. Bank of Baroda and Canara Bank also reported an 8% annual growth. Canara Bank and Union Bank followed with 10% and 7% growth, respectively. While SBI retained its top position, it saw a significant decline of about 9% year-on-year in September.

Bank of India experienced an even larger drop, with a 19% decline, while ICICI Bank reported a 2% drop. Punjab National Bank saw no change with a 0% growth rate for the same period, as per the data.

Debit and credit card transactions in India have seen a steady compound annual growth rate (CAGR) of 20% and 19%, respectively, over the past four years. According to PwC India, there were 71 million active credit cards in FY22, with projections suggesting card-based transactions will continue to grow at an annual rate of around 16% over the next four years.

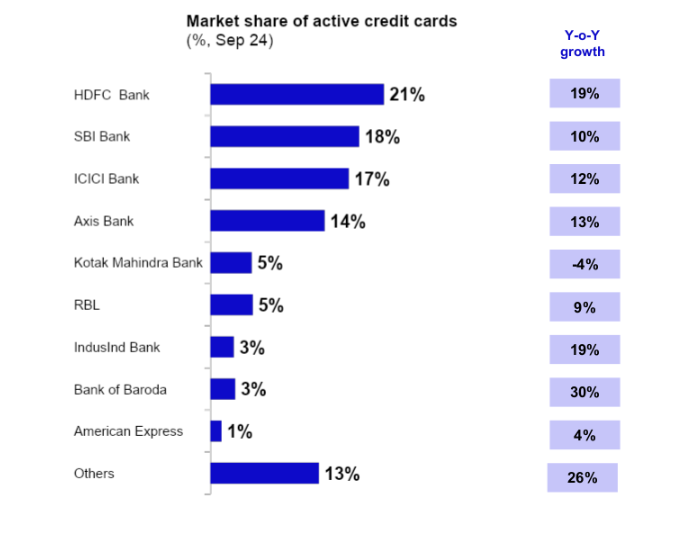

HDFC Bank leads Credit Card market

As India’s largest private-sector lender, HDFC Bank continued to dominate the credit card market, holding a 19% share in September. It was followed by SBI Cards, ICICI Bank, and Axis Bank, which held market shares of 10%, 12%, and 13%, respectively, according to 1Lattice data.

Bank of Baroda saw the highest growth in the credit card segment with a remarkable 30% year-on-year increase, followed by HDFC Bank and IndusInd Bank, each with 19% year-on-year growth, holding shares of 21% and 3%, respectively.

Axis Bank and ICICI Bank followed, posting year-on-year growth of 13% and 12%, respectively. SBI Cards and RBL Bank also grew, with 10% and 9% year-on-year increases, respectively.

On the other hand, Kotak Mahindra Bank saw a 4% decline in growth, holding a 5% share in the credit card market.

Global players in the credit card space saw moderate growth, with American Express posting a year-on-year increase of just 4%, accounting for only a 1% market share, according to the data from 1Lattice.

Leave a Reply